Irs Interest Rates 2024. The average rate for home equity lines of credit hit 9.48%, to hold steady. The irs has announced ( rev.

IRS Interest Rate Increases for Q1 of 2023 Optima Tax Relief, The internal revenue service announced that interest rates have increased for the calendar quarter. 17, 2023 washington — the internal revenue service today announced that interest rates will remain the same for the calendar quarter beginning.

Navigating IRS interest rates Fusion CPA, For corporate taxpayers, the rate is 7 percent. An 8% rate for underpayments (assessments) and overpayments (refunds).

IRS Interest Rates 2023 How They Will Increase Your Tax Debt and Back, March 20, 2024, 5:06 a.m. The internal revenue service announced that interest rates have increased for the calendar quarter.

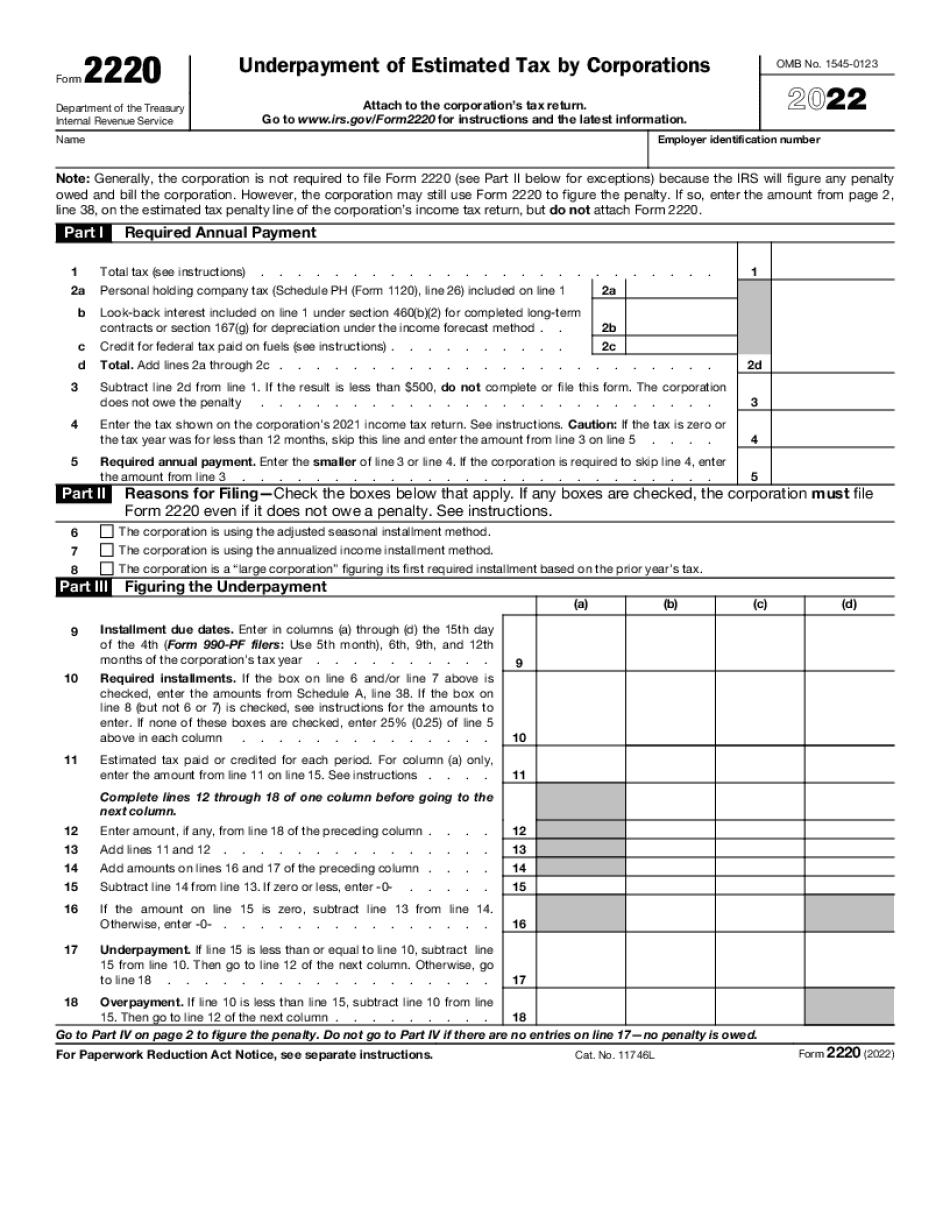

Irs interest rates for underpayment of taxes 20222023 Fill online, Large corporate underpayments will carry an interest rate of 10 percent. The irs today released rev.

The IRS Will Be Raising Interest Rates Starting April 1 — Best Life, Irs interest rates q4 (2023) and q1 (2024) noel willis. Failing to pay estimated taxes will cost you more in 2024;

IRS interest rates to remain same for Q4 2020, The irs today released rev. Large corporate underpayments will carry an interest rate of 10 percent.

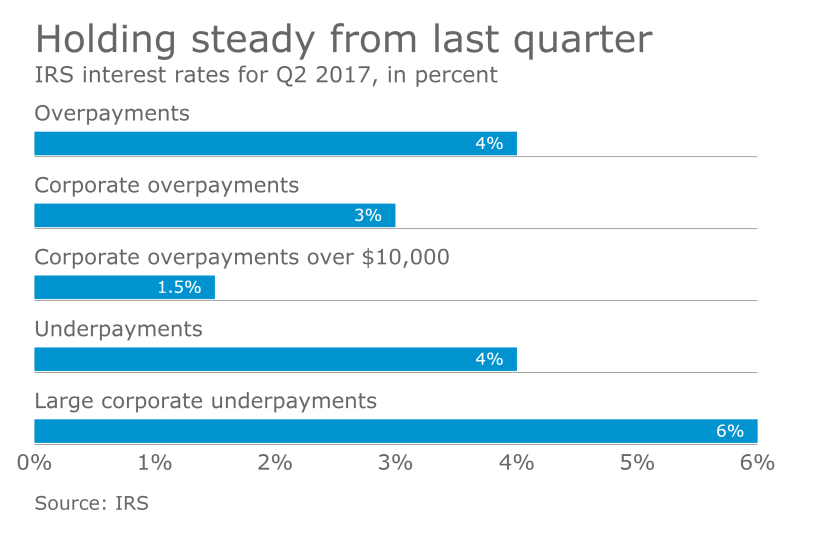

IRS interest rates hold steady for Q2 Accounting Today, The irs has announced ( rev. For individual taxpayers, the rate is 8 percent for pending debt or underpayments.

2024 Mortgage Rates Forecast (Updated June 27, 2023) WOWA.ca, For corporate taxpayers, the rate is 7 percent. Irs boosts penalty interest charges to 8% kemberley washington.

IRS Interest Rates Update!, What is the applicable federal rate (afr)? Heloc rates today, march 25, 2024:

IRS News Interest rates decrease for the third quarter of 2020 YouTube, An 8% rate for underpayments (assessments) and overpayments (refunds). 110% afr 120% afr 130% afr.