With great pleasure, we will explore the intriguing topic related to Best Target Date Funds for 2055. Let’s weave interesting information and offer fresh perspectives to the readers.

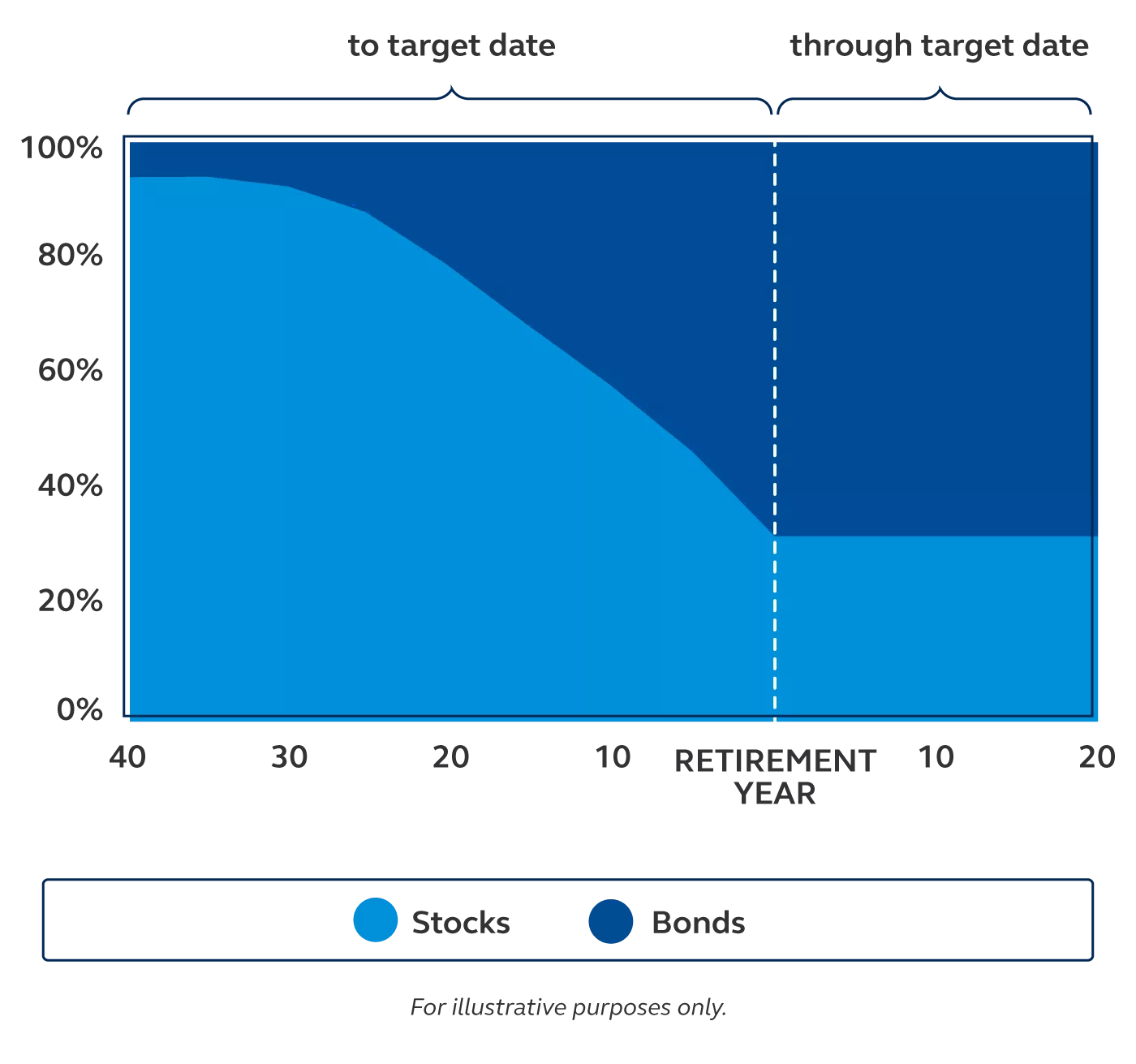

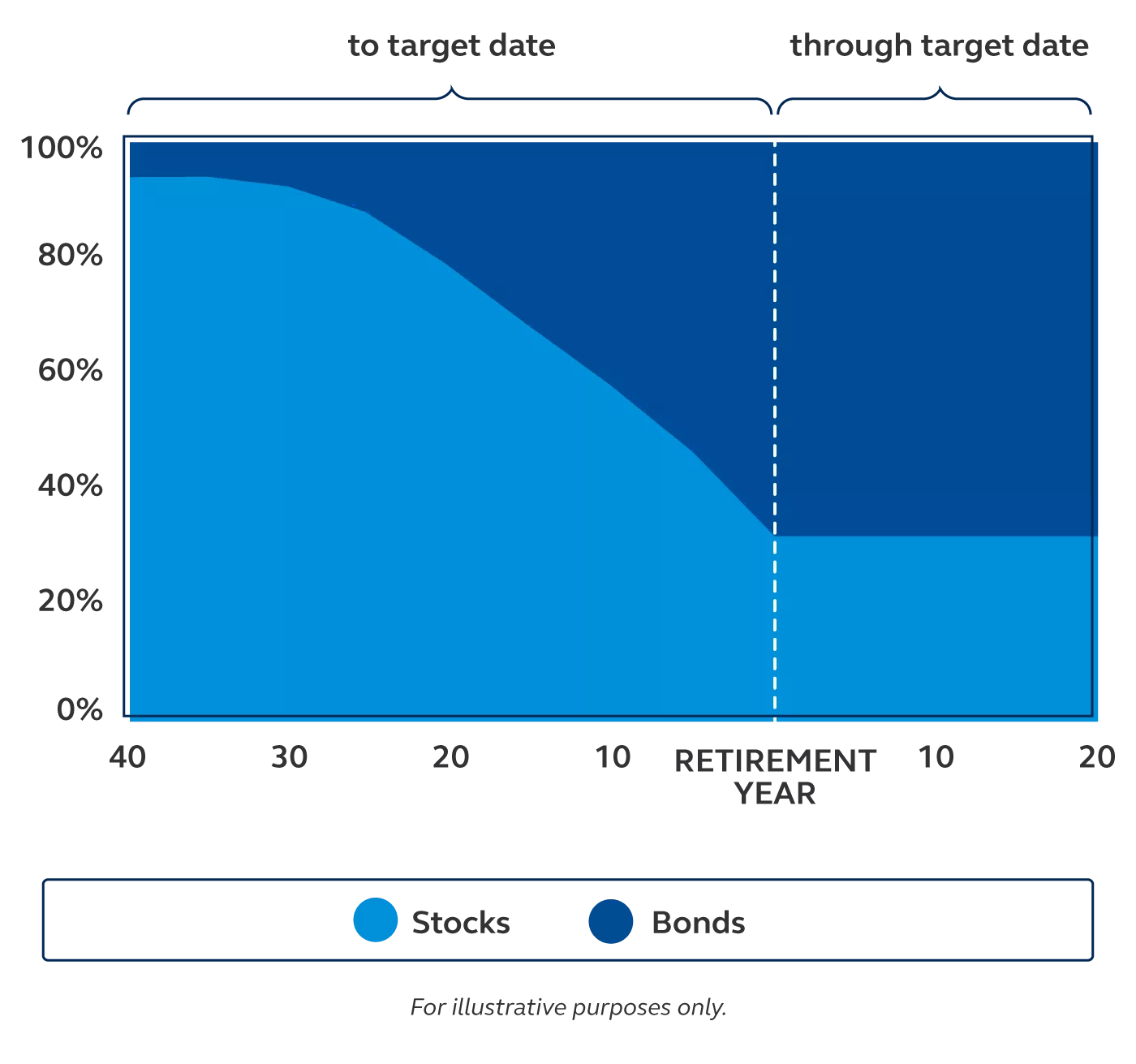

Target date funds are a type of mutual fund that automatically adjusts its asset allocation based on your expected retirement date. As you get closer to retirement, the fund will gradually shift its investments from stocks to bonds, which are typically less risky. This helps to reduce your risk of losing money in the years leading up to retirement.

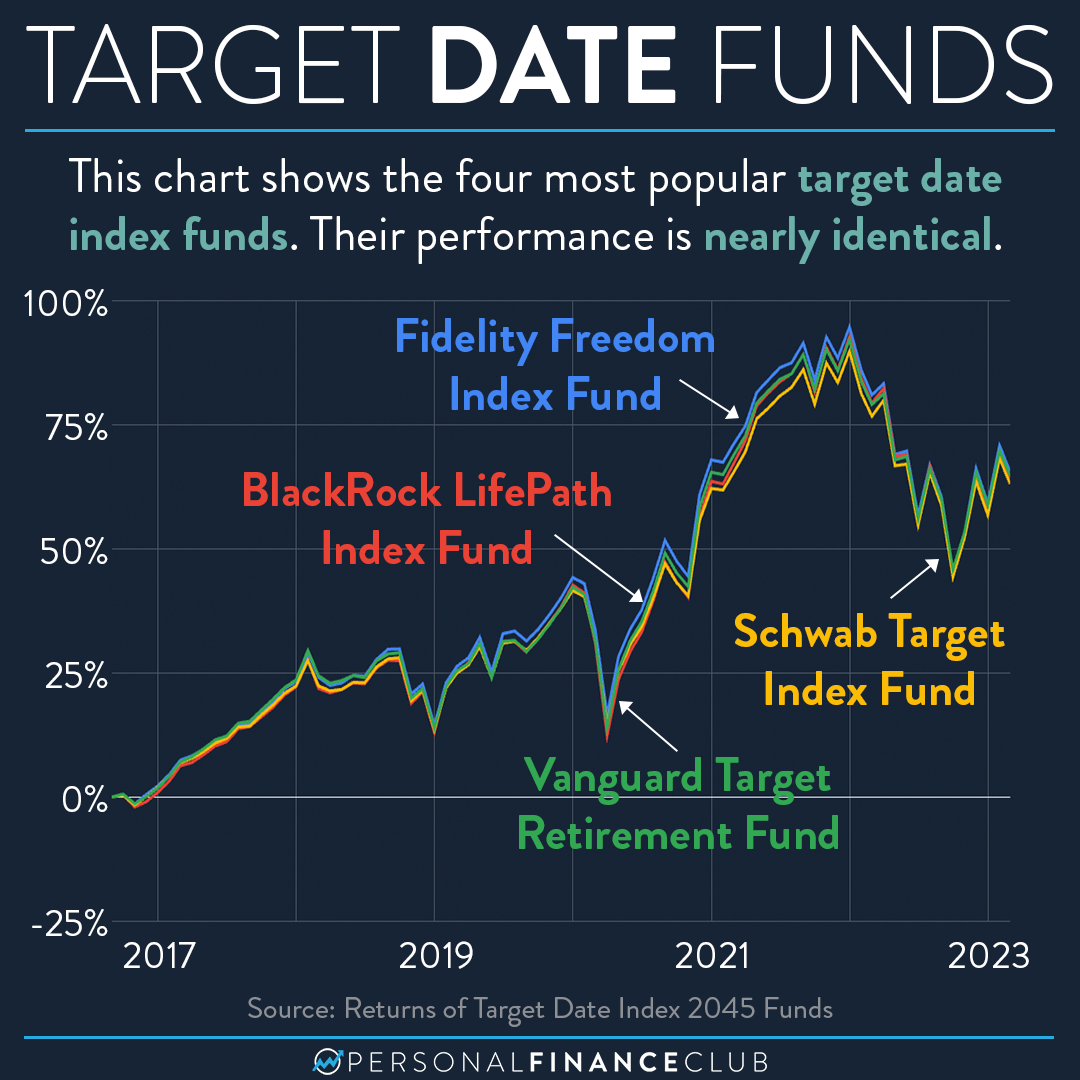

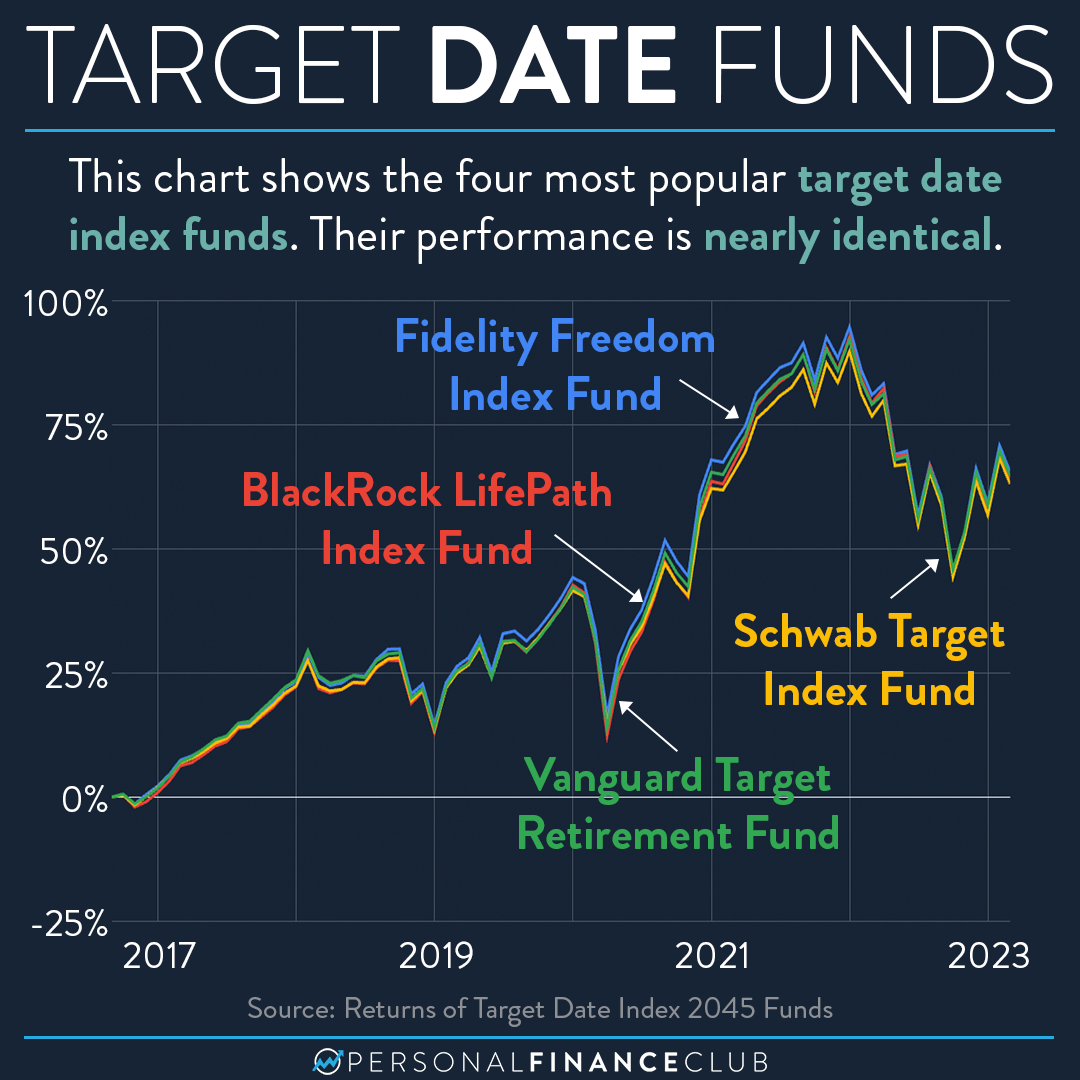

Target date funds are a popular choice for investors who want a simple and hands-off approach to retirement planning. However, not all target date funds are created equal. Some funds have higher fees than others, and some funds invest in more aggressive or conservative assets than others.

These funds have low fees, a reasonable asset allocation, and a strong performance record. They are a good choice for investors who are looking for a simple and hands-off approach to retirement planning.

Target date funds are a good choice for investors who want a simple and hands-off approach to retirement planning. However, not all target date funds are created equal. When choosing a target date fund, be sure to compare the fees, asset allocation, and performance of different funds.

Thus, we hope this article has provided valuable insights into Best Target Date Funds for 2055. We hope you find this article informative and beneficial. See you in our next article!